Quit your 9-5 job with our ultimate guide. Learn how to leverage online ventures and, cultivate the right mindset.

Introduction:

Transitioning from a conventional 9-5 job to a self-directed, financially independent lifestyle is a quest many embark upon, yet few manage to achieve. The journey requires a blend of self-awareness, education, clear goal-setting, strategic investment in learning, a growth mindset, exploring online ventures, mindfulness, and avoiding common pitfalls. Inspired by a 19-year-old Reddit user’s quest, this guide aims to provide a roadmap to help you quit your 9-5 job.

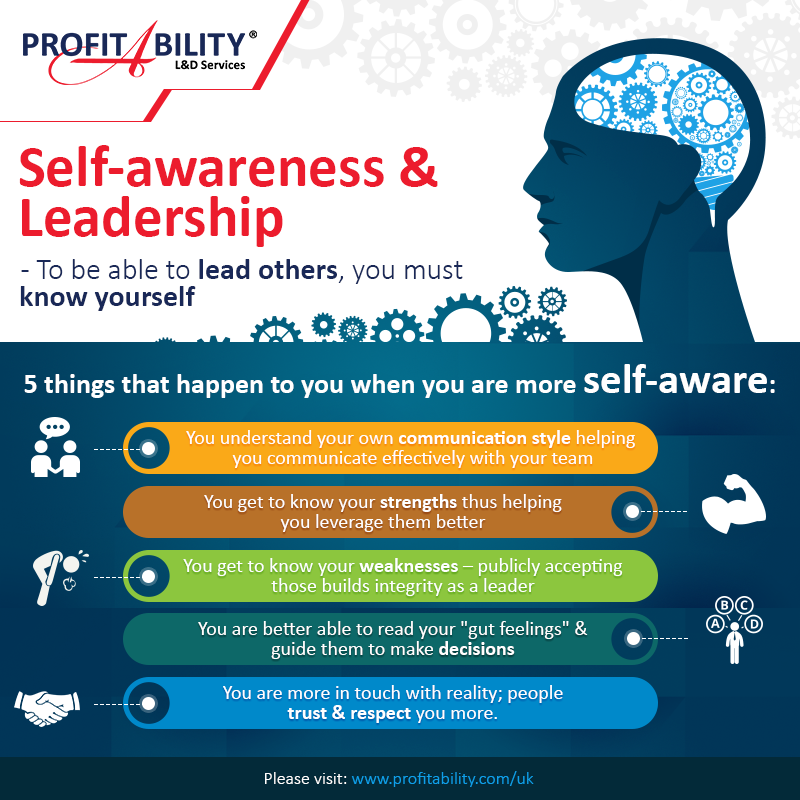

Quit Your 9-5 Tool 1: Self-Awareness

Self-awareness is the cornerstone of initiating change in your life. Unlike the routine of a 9-5 job, where tasks and goals are often dictated by organizational agendas, venturing into financial independence requires a deep understanding of your desires, strengths, and weaknesses.

Engage in self-reflection exercises, consider utilizing personality assessments like the Myers-Briggs Type Indicator or the StrengthsFinder, and envision your ideal lifestyle. These steps will provide a strong foundation for your journey by aligning your actions with your aspirations and capabilities.

Quit Your 9-5 Tool 2: Educate Yourself

Traditional education often channels individuals towards conventional employment, offering little insight into the vast avenues for generating income independently. However, breaking free from the 9-5 mold necessitates a self-driven quest for knowledge.

Dive into books like “Rich Dad Poor Dad” by Robert Kiyosaki, enroll in online courses on platforms like Coursera or Udemy that offer training on entrepreneurship or digital marketing, and attend networking events or seminars like the ones hosted by SCORE, a non-profit association dedicated to helping small businesses get off the ground.

3. Set Clear Goals

Setting clear and achievable goals is pivotal in your journey towards financial freedom. Unlike the structured career progression in traditional employment, the path to financial independence requires personalized, well-defined goals.

Detail your financial goals, break them into short-term and long-term milestones, and create actionable plans to achieve them. Utilize tools like the SMART Goals framework to ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

4. Invest in Learning

Investing in learning and personal development is often overlooked in traditional employment scenarios. With $5,000 saved, our Reddit user has a solid foundation to invest in learning new skills, enrolling in courses, or seeking mentorship opportunities this will boost you when you quit your 9-5.

Allocate a portion of your savings towards acquiring knowledge and skills that can fuel your journey toward financial freedom. Platforms like MasterClass or LinkedIn Learning offer various courses to help you hone skills essential for your chosen path.

5. Harness the Power of Mindset

Cultivating a growth mindset, the belief that your abilities can be developed through dedication and hard work is paramount. Unlike the fixed mindset often fostered in traditional job settings, a growth mindset encourages adaptability, resilience, and a continuous learning attitude.

Delve into books like “Mindset: The New Psychology of Success” by Carol S. Dweck or “Grit: The Power of Passion and Perseverance” by Angela Duckworth to deepen your understanding of growth mindset principles. Consider also exploring mindfulness and meditation practices through platforms like Headspace or Calm, which can help cultivate a positive, goal-oriented mindset essential for navigating the challenges of financial independence and quitting your 9-5 job.

6. Explore Online Ventures

The digital realm unfolds many opportunities to generate income beyond the traditional 9-5 job framework. Here are some specific paths:

- Affiliate Marketing: Promote products or services for a commission. Platforms like Amazon Associates or ShareASale offer good starting points.

- E-commerce: Launch an online store on platforms like Shopify or Etsy, selling products directly to consumers.

- Freelancing: Offer your skills on platforms like Upwork or Fiverr. Whether writing, graphic design, or web development, freelancing can earn significant income.

- Content Creation: Platforms like YouTube or Instagram can be lucrative for those passionate about video or photography. Consistent content creation coupled with monetization strategies like ads, sponsorships, and merchandise sales can lead to substantial earnings.

7. Mindfulness and Inner Reflection

Engaging in mindfulness practices can provide clarity and reduce stress as you navigate the path to financial independence. Attend mindfulness workshops or retreats, such as those offered by the Mindfulness Training Institute, to deepen your understanding and practice of mindfulness.

Incorporate daily practices like meditation or yoga into your routine. Establishing a regular mindfulness practice can help maintain a balanced and focused approach, providing a solid mental foundation as you work towards your financial goals.

8. Avoid Common Pitfalls

The journey towards financial independence is laden with potential pitfalls. Equipping yourself with knowledge and foresight can help navigate these challenges while working on getting to quit your 9-5:

- Education: Reading “Outwitting the Devil” by Napoleon Hill can provide insights into overcoming fear and procrastination, common hurdles in pursuing financial independence.

- Financial Management: Employ sound financial management practices to avoid debt and ensure you have the resources to invest in growth opportunities. Consult with a financial advisor or utilize budgeting apps like YNAB (You Need A Budget) to keep your finances in check.

Conclusion: Embark on Your Journey Towards Financial Independence

Transitioning from the 9-5 grind to a realm of financial independence is an empowering journey filled with self-discovery, learning, and growth. This comprehensive guide has been crafted to provide actionable tools and specific resources to serve as your companions along this exciting path.

As you set forth on this adventure, here’s a roundup of the critical resources and platforms mentioned throughout the guide, conveniently grouped for easy reference:

Self-Awareness Tools:

- Personality assessments: Myers-Briggs Type Indicator, StrengthsFinder

Educational Resources:

- Books: “Rich Dad Poor Dad” by Robert Kiyosaki

- Online Courses: Coursera, Udemy

- Seminars and Networking: SCORE Workshops

Goal-Setting Framework:

Investment in Learning Platforms:

Mindset Development Resources:

- Books: “Mindset: The New Psychology of Success” by Carol S. Dweck, “Grit: The Power of Passion and Perseverance” by Angela Duckworth

- Mindfulness Apps: Headspace, Calm

Online Venture Platforms:

- Affiliate Marketing: Amazon Associates, ShareASale

- E-commerce: Shopify, Etsy

- Freelancing: Upwork, Fiverr

- Content Creation: YouTube, Instagram

Mindfulness Training:

Financial Management Resources:

- Books: “Outwitting the Devil” by Napoleon Hill

- Budgeting App: YNAB (You Need A Budget)

These resources, paired with the strategic tools outlined in this guide, equip you with a robust framework to navigate your way toward financial independence and quit your 9-5 in six months. The journey may pose challenges, but with the right resources, a fulfilling and financially autonomous life is well within reach. Your venture into financial freedom begins with a decisive step. Armed with this guide, take that step today, and set the stage for a life replete with financial freedom and personal fulfillment.