Caution: Warning: Before unveiling the secrets of financial mastery, heed this profound wisdom: ‘There are no limitations to the mind except those we acknowledge.’ (Napoleon Hill). Explore the mystical journey of self-transformation, for it holds the key to unlocking the seven sacred money moves that shape your destiny.

Money Management Tips for Young Adults: Building Wealth in Your 20s

Are you a young adult caught between the excitement of your late teens and the daunting prospect of your early 20s? It’s a phase where financial independence might seem like a distant dream, but it’s also a crucial time to shape your future. The decisions you make between 18 and 20 can lay the foundation for financial freedom

Realizing the Potential: 18 to 22, the Formative Years

At 19, I felt so far behind that I didn’t even want to start. The pressure to keep up with friends living it up, attending parties, wearing expensive shoes, and seemingly having the time of their lives can be overwhelming. But I’ve learned since then that the years between 19 and 22 are a pivotal period that can either make or break your financial future.

You can choose to fritter away this time on endless parties, following the crowd, and embracing a lifestyle of instant gratification. However, if you shift your focus and realize you’ll still be young at 22, you can set the stage for financial independence and long-term success. I wish I had known this back then.

This comprehensive guide will explore the practical advice and the “why” behind each key financial move. These strategies will not only help you navigate your 20s but also lay the groundwork for a prosperous future.

Money Move #1: Read Daily – Cultivating a Lifelong Learning Habit

Many young adults underestimate the power of reading daily. It might seem trivial initially, but it’s your key to gaining knowledge from various sources and forming your unique perspective on life. The habit of reading is about developing a passion for learning, which is the foundation of success.

I recommend diving into books like ‘The Millionaire Mindset,’ which can help you understand how your beliefs about money can significantly influence your financial success. Reading is not just about acquiring knowledge; it’s about developing the skills and mindset required to thrive financially.

Money Move #2: Surround Yourself with Success – Harnessing the Power of Peer Influence

It’s often said that you are the average of the five people you spend the most time with. Surrounding yourself with successful individuals, even if they earn significantly more than you, isn’t about comparison. It’s about learning from those who have achieved what you aspire to.

Success tends to breed success, and your friends today are pivotal in shaping who you’ll become tomorrow. If your circle is more concerned about partying, getting laid, drinking, smoking, or indulging in unhealthy habits, chances are you’ll follow suit. On the other hand, if your friends are genuinely focused on starting large companies, inspiring people, or earning 10k-20k, 100k per month, you will likely adopt similar ambitions and work ethic.

Let’s emphasize an essential point: it’s not about shunning friends or judging their choices. Instead, it’s about being intentional with your circle and recognizing its impact on your life. Surround yourself with people who inspire and motivate you to chase your dreams.

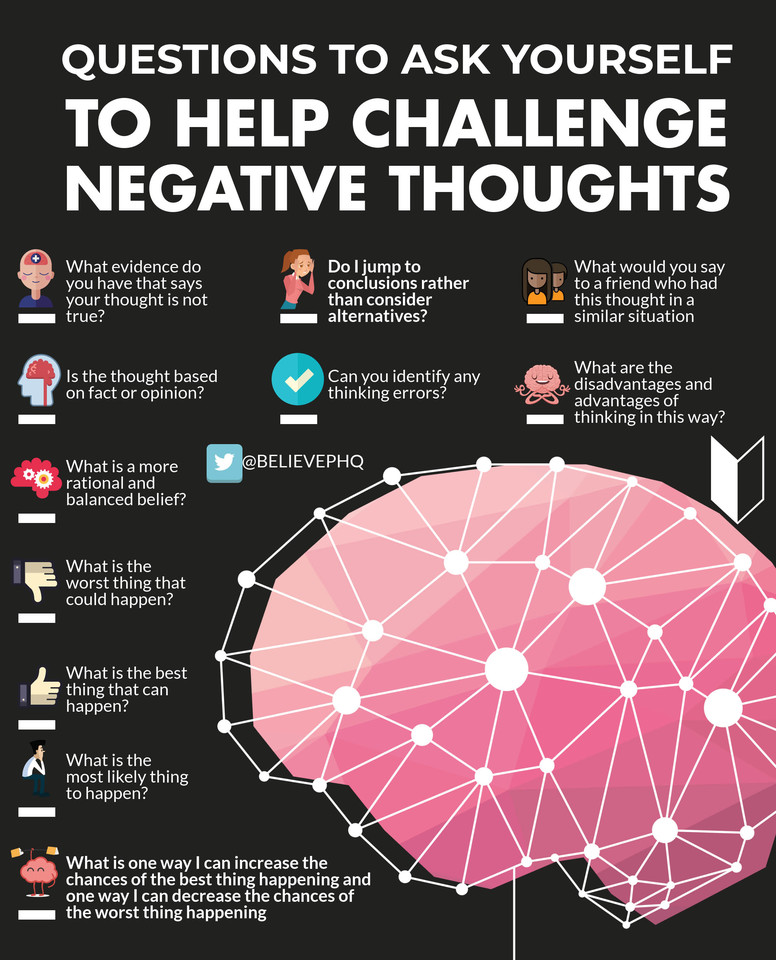

Money Move #3: Guard Against Negativity – Mastering Your Mindset

Negativity is a mindset that can hold you back. Surrounding yourself with negative people or constantly complaining only perpetuates this negativity. By practicing gratitude, you create a positive outlook that attracts success and well-being.

Additionally, understanding your brain’s Reticular Activating System (RES) can help you appreciate how focusing on positive or negative thoughts can shape your reality. Books like ‘The Secret’ delve into this concept, explaining how your thoughts and intentions influence your experiences.

The RES acts like a filter, tuning into the thoughts and information that align with your focus. If you consistently dwell on negative thoughts and limitations, your RES will magnify these aspects, ultimately hindering your progress.

Money Move #4: Attention to Detail – Small Habits, Significant Impact

The way you handle small tasks reflects your approach to larger ones. Making your bed and keeping a clean space isn’t just about tidiness; it’s about maintaining a clear mind. A cluttered environment can lead to procrastination, scattered thoughts, and a lack of confidence.

The importance of this practice is beautifully exemplified in ‘The Matrix.’ After taking the red pill, the protagonist’s first act is to clean his living space. This simple act symbolizes that a clean external environment leads to a clear state of mind, a prerequisite for taking charge of one’s life and shaping a successful future.

Money Move #5: Work on Yourself First – The Foundation of Wealth

Self-development is the cornerstone of financial success. It’s about recognizing your self-worth and challenging limiting beliefs about money. By creating your beliefs about money and rejecting unhelpful notions like ‘money is the root of all evil’ or ‘rich people are evil,’ you open the door to financial success.

The process starts with understanding yourself, your goals, and your values. It involves self-reflection and a willingness to grow, adapt, and change. Books like ‘The Millionaire Mindset’ and ‘Think and Grow Rich can help you understand and reshape your beliefs about money, success, and wealth.

Money Move #6: Setting Clear Financial Goals – Your North Star

Setting clear financial goals is more than just a suggestion; it’s necessary. Without specific objectives, you’re like a ship adrift in the vast sea of life, lacking direction and purpose.

Your goals can be both short-term and long-term. Whether saving for a down payment on a house, paying off student loans, or starting a business, having well-defined targets will help you stay motivated and on track. It’s crucial to break down your goals into actionable steps and create a timeline for achieving them.

Money Move #7: It’s Not a Race – Your Unique Journey to Financial Independence

Remember that life is not a race, and everyone’s journey is unique. It’s easy to feel pressured to achieve success by a certain age, especially when you see your peers apparently ahead in the game. However, success is a deeply personal concept, not solely defined by age, wealth, or social status.

By following these steps and continuously improving yourself, you’ll establish a strong foundation for financial independence. You’re young, and you have the time to learn, grow, and create a prosperous future for yourself. Each day allows you to progress and move closer to your financial goals.

Additional Insights and Recommendations:

In addition to the seven key money moves, there are further insights and recommendations to enhance your financial knowledge and empower you to make informed decisions.

The Power of Visualization:

Visualization is a potent tool for achieving your goals. When you visualize your dreams and desires, you’re more likely to work actively toward making them a reality. Visualize your success, and it will become a dominant theme in your life.

The Pitfalls of Temporary Defeats:

Many people mistakenly label temporary setbacks as failures. In reality, setbacks are part of the journey to success. When you encounter obstacles or face challenges, view them as opportunities for growth and learning. Embrace them and keep moving forward.

The Necessity of ‘Needing’ It:

To succeed, you must not merely ‘want’ success – you must ‘need’ it. Your desire for success should be so strong that it fuels your determination and persistence. It’s this burning need that drives individuals to keep going, no matter how tough the journey becomes.

Recommended Books:

For further insight into financial success and personal development, consider reading the following books:

- ‘Think and Grow Rich’ by Napoleon Hill

- ‘Outwitting the Devil’ by Napoleon Hill

- ‘The Power of Believing’ by Claude M. Bristol

- ‘The 4-Hour Workweek’ by Timothy Ferriss

- ‘The Laptop Millionaire’ (a bit outdated but valuable) by Mark Anastasi

- ’10X Rule’ by Grant Cardone

- ‘Rich Dad Poor Dad’ by Robert Kiyosaki

Transforming Your Financial Perspective:

Shifting your financial perspective can lead to multiple streams of income. This transformation begins when you change how you view the world and your potential. Challenge conventional wisdom and adopt a growth mindset to explore innovative financial opportunities.

Daily Application:

Practical steps you can apply each day include making your bed to instill discipline and order, reading at least one chapter a day to foster a habit of continuous learning, and setting a substantial, inspiring goal for yourself to maintain your drive and motivation.

The Importance of Critical Thinking:

In a world filled with information, the ability to think critically is a valuable skill. Avoid becoming a ‘drifter,’ someone who passively accepts information without question. Instead, challenge assumptions and judge for yourself. Critical thinking is a foundation for making informed financial decisions.

In summary, your late teens and early 20s are crucial to shaping your financial future. By following these seven essential money moves, in addition to the insights and recommendations provided, you’ll build a strong financial foundation and set yourself on a path to a prosperous future. While it may seem challenging, remember you’re not alone on this journey. Your future self will undoubtedly thank you for the wisdom and determination you’ve exhibited during these formative years.

Take Action This Week

Pick at least one of these seven money moves to get started and implement it this week. Whether diving into a book, surrounding yourself with success, or setting clear financial goals, every small step you take now will bring you closer to your economic aspirations. Your future self will thank you for the wisdom and determination you’ve exhibited during these formative years.

In the next section, we’ll delve into these key money moves, providing in-depth insights and recommendations to implement in your journey toward financial independence. Your 30-year-old self will appreciate the dedication you’ve shown today.

1. Start Early: The Power of Compound Interest

The Art of Saving:

When you’re young, saving may seem unexciting compared to spending on immediate pleasures. However, there’s immense power in saving, and it’s a skill that should be honed early. Even modest contributions to your savings account can compound over time.

Investing Wisely:

Beyond savings, consider investing your money. Investing in low-cost index funds or Exchange-Traded Funds (ETFs) can provide a diversified portfolio that grows over time. The earlier you start, the more you’ll benefit from the exponential growth of your investments.

2. Build a Solid Financial Foundation

Budgeting Basics: Creating a budget is the first step toward understanding your financial situation. It allows you to track your income, expenses, and savings goals. Many budgeting apps are available to assist you in this process. Learning to manage your money effectively will serve as the cornerstone of your financial success.

Emergency Fund: Establishing an emergency fund is essential. It provides a safety net for unexpected expenses, such as medical bills or car repairs, without derailing your financial plans. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

Final Thoughts: Your Journey to Financial Independence

You’re embarking on a journey that will shape your financial future. While the road may have challenges, each step brings you closer to the prosperous life you envision. Embrace the wisdom of these key money moves and allow them to guide your actions. Remember that success is a journey, and there’s no rush. Your unique path to financial independence is yours to create, so make the most of it. Your financial destiny awaits – make it a great one.